Free Car Insurance Comparison

Compare Quotes from Top Companies and Save

Secured with SHA-256 Encryption

Compare Auto Insurance Companies

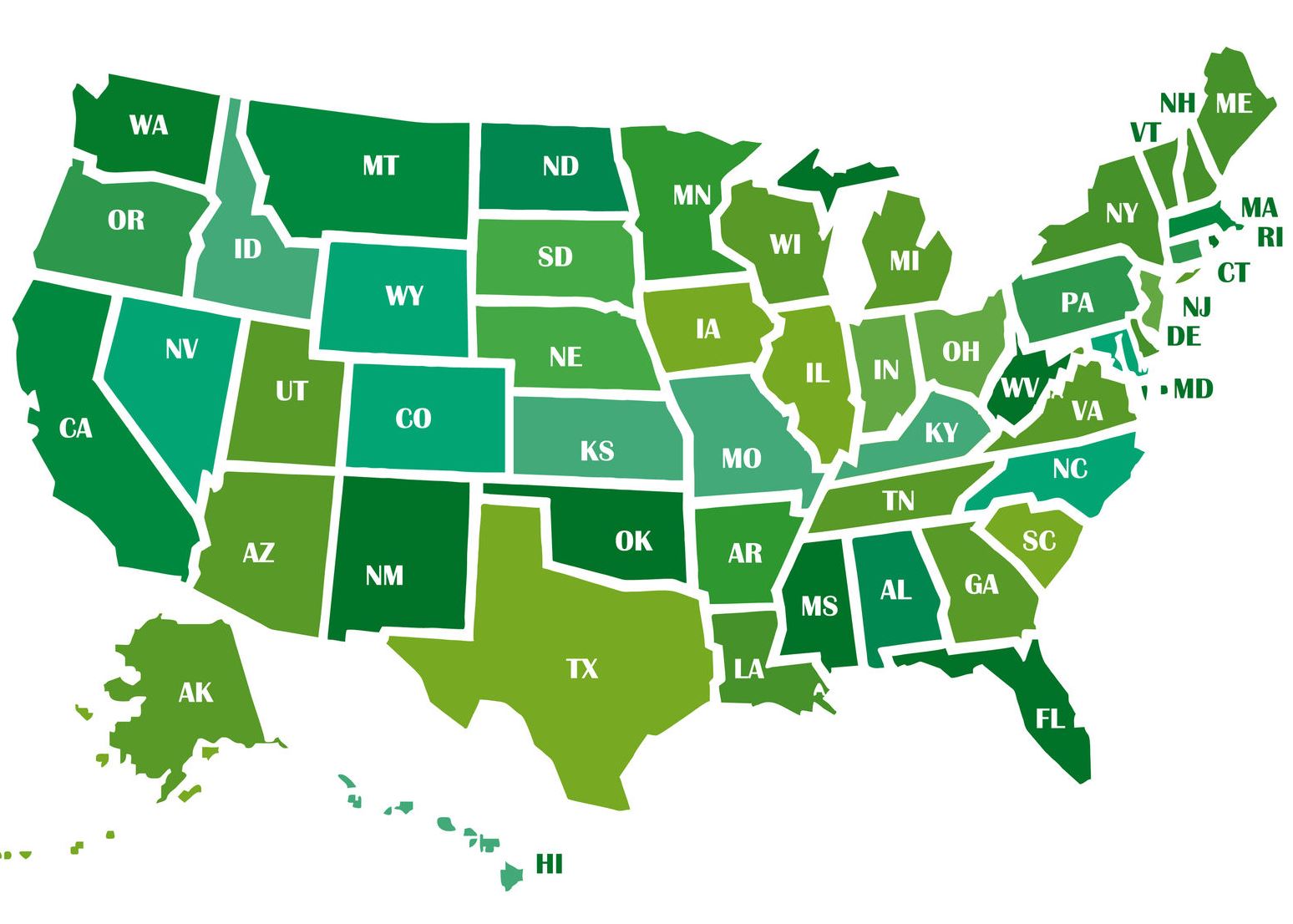

When shopping for insurance coverage for your vehicle, the ability to access hundreds of quotes from dozens of companies in one place is the epitome of online shopping convenience. By simply entering your ZIP code and some other quick information - like your age, vehicle type, and marital status - you can be sure to find the lowest price available and compare auto insurance rates.

Insurance rates vary from city to city, state to state, and company to company, depending on what type of coverage you need. By choosing to compare auto insurance quotes side-by-side online, you have made the best first step toward amazing savings!

Benefits Of Using An Online Comparison Tool

It can often take 15 minutes or longer to obtain an insurance quote from an auto insurance provider online or over the phone. In addition to the length of time, keeping track of multiple quotes from multiple companies can often be a paperwork nightmare. The ability to check rates with many companies at the same time online with an easy comparison tool provides a number of convenient benefits:

1. Save Time - By entering all of your information in one form and letting us do the work for you, you are free to do something productive while you wait 60 seconds or fewer for your quotes. You can save minutes - or even hours - over shopping around company by company.

2. Easily Compare Quotes - With the ability to search dozens of auto insurance companies in one place at one time, you will also find that you are able to view multiple quotes at the same time. This allows you to easily select the quote that provides the most value for the price, without switching from screen to screen. If you want to zoom in on certain quotes, a side-by-side comparison tool will allow you to view individual pieces of the policy you are interested in, and let you decide which one is best for you.

3. Select a Policy - Once you have found the quote from a company that best matches what you need, you can easily locate the information for the insurance company you selected, and contact them right away. Often, you can even sign up online, without leaving your home or the comfort of your desk.

Obtaining Coverage

Now that you know the benefits of shopping for insurance and comparing auto rates online, it is time to think about purchasing insurance. Most people are interested in auto insurance because they are looking at or have already bough an automobile. If you already have a vehicle, you have probably purchased insurance before. As long as you have the required information ready, the process should be smooth, easy, and stress-free.

There are a few pieces of information every insurance company will need when you decide to purchase a policy through them. Some companies require more items of information, but these five pieces of documentation are usually essential:

- - Driver's License

- - Vehicle Identification Number (VIN)

- - Vehicle make and model information

- - Lender name (if any)

- - Title (if you own the vehicle)

When you have all of the required information gathered, it is time to purchase your well-researched and high-quality insurance plan. Some people feel more comfortable choosing a company with an office in their area so they can purchase their policy in person from an agent. This allows them to interact with an insurance professional, and get answers to questions immediately. Others prefer the convenience of purchasing over the phone, so they do not have to leave the comfort of their homes.

This is a great way to purchase for people that live in areas with low-speed internet connections, or may live in areas without easily accessible insurance offices. Most people, though, prefer to purchase the insurance quote they viewed online...well, online. This added benefit adds a quality of service only found on the internet. Some companies offer online chat functions, so you can still ask questions and get quick answers.

Congratulations! You have now purchased an auto insurance policy you found online! You can feel confident you have selected the best quote for you, and you got a great price. The easy comparison tools you found here should leave you feeling like you made a good choice.

What If I Have Not Bought A Car Yet?

If you are comparing auto insurance rates online and are looking at vehicles at the same time: great! You are being a wise consumer and researching all aspects of vehicle ownership before you buy. This is definitely the best way to purchase a vehicle and the insurance to cover it. Your responsibility now will certainly pay off in the future; you will find you can stick to your budget and take advantage of great insurance rates - before you by.

Whether you are purchasing a car from a dealer or private seller, or you are using cash or have secured a loan, selecting a vehicle you can afford to insure is as important as selecting one you can afford to make payments on.

Other Ways To Save On Insurance

You have already made some great progress in saving on your car insurance by using an online insurance rate comparison tools. Lucky for you, there are other ways you can save on your auto insurance, too. Most insurance companies offer discounts to certain individuals and current policyholders. Here are a few discounts you should inquire about, if they apply to you:

Good Student Discount: If you are in college - or even high school - maintaining good grades and providing proof to your provider is a great way to save money on the insurance policy you purchase for your car.

Clean Driving Record Discount: Another easy way to save money on your insurance is to make sure you have a clean driving record. Following speed limits and traffic laws, as well as being observant and paying attention to the road and other vehicles around you seems like common sense, but over 41 million speeding tickets are issued in the United States alone. Driving safe and driving smart could just end up saving you money.

Multiple Vehicle Discount: If you own more than one vehicle, or live in a household with more than one car, it is very possible you could save money on your auto insurance if you listed all vehicles on one policy.

Marriage Discount: Married people often receive discounts on their car insurance, as statistics show married couples tend to be safer drivers. As long as both members of the couple are on the policy, the discount will usually apply.

Bundle Discount: Many auto insurance providers also provide other types of insurance. If you already have another type of policy with a different company that is also offered by your car insurance carrier, it is worth researching to see if you could save money by switching. Here are some common policies that are frequently bundled with auto insurance:

- - Homeowner's Insurance

- - Renter's Insurance

- - Motorcycle Insurance

- - Boat Insurance

- - Life Insurance

It is completely acceptable for the prospective insurance buyer to inquire about company-specific discounts, as well. Before you finalize your insurance purchase, ask about what discounts, if any, the insurance company offers. If a discount involves purchasing another policy, feel free to ask any questions you have. Insurance agents are familiar with making sure their customers are informed - they want you to feel secure and confident in your choice of insurance.

Choosing the Right Deductible

One more important way for you to save on car insurance is to select a higher deductible option. Your deductible is the amount of money you have to pay toward damages before the insurance provider you select begins to pick up the cost of repairs to your vehicle. If you raise the amount of the deductible, you lower the amount of money the insurance company potentially has to spend, which will result in lower monthly, bi-annual, or annual insurance premiums.

Down The Road

After you have had your policy for a while, and you are comfortable with your agent - and your car - you still have a couple of things to consider. You can continue making your insurance payments like normal, and that will be that. When you purchase your next vehicle, you will need to notify the insurance company, as your rates will most likely change.

There is another option, however; based on your payment history, insurance products, and driving record, you may be eligible for a rate adjustment. Usually, it is up to you to inquire about and request an adjustment, but some companies now notify you when and adjustment is available, and ask you if you would like to take advantage of it. If your coverage stays the same - or even improves - and the price is the same or lower, the logical thing to do is take the offer!

Eventually, you will probably purchase another vehicle in your lifetime. That also means you will find yourself in the position to purchase another auto insurance policy. At that time, we hope your experience with autoinsurancecompanies.net was positive enough to bring you back for more easy insurance rate comparisons.

Enter Your Zip Code NOW to Compare Auto Insurance Quotes!

Free Car Insurance Comparison

Compare Quotes from Top Companies and Save

Secured with SHA-256 Encryption