3 Reasons High Risk Auto Insurance Rates Are Higher

The main three reasons high-risk auto insurance rates are higher include poor judgment, reckless behavior, and inexperience. When you tie these elements together, the auto insurance industry places you into the high-risk category.

The main three reasons high-risk auto insurance rates are higher include poor judgment, reckless behavior, and inexperience. When you tie these elements together, the auto insurance industry places you into the high-risk category.

Hunting for the top car insurance rates can start today by putting your ZIP code into the FREE tool!

Because car coverage rates vary in all states, your provider may include any of these reasons for raising your premiums. First, review the particulars where you live, as this can help you understand where companies place you.

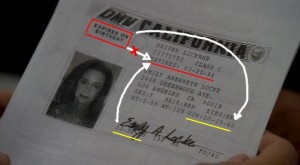

A Short Driver’s License Record

Generally, every state considers inexperienced drivers a high risk. States usually place the minimum experience at three years. Anyone driving without three or more years’ experience can expect to have higher car insurance rates. This is certainly true in California.

If you live in California, you should familiarize yourself with Proposition 103, especially if you are a young driver. With the passing of this law, the auto insurance industry can only charge consumers a higher rate for their coverage if they meet precise criteria.

The primary factor is a short driving history. Unfortunately, this pinpoints one age demographic: specifically, teen drivers. Perhaps this is because you can acquire a driver’s license in California at 16 years old. However, you must pass several courses and receive certification.

Other states, especially those in the southern region of the United States, follow the same guidelines and allow teens as young as 15 ½ to start their driving instruction while in school. This is to guarantee that teen drivers adhere to the laws.

Youths residing in New York, New Jersey, Connecticut, and other East Coast states must wait until age 17 before applying for a driver’s license, but this is still quite young.

After all, drivers between 15 and 17 may not realize their level of responsibility once they begin driving.

This will likely increase the odds of paying more for car insurance until they reach 19 or 20 years of age. After the first three years, the car insurance provider may begin lowering their rates if their record is clean. Still, there are ways to find competitive rates for teens.

Suspended Driver’s License

More experienced drivers who do not fit into the under-three-year category can also find themselves paying more for car insurance. These types of drivers exercise reckless behavior that leads to suspension of their driving privilege.

There are several ways to lose your license. One of the more common reasons is driving without proper auto insurance coverage. Unfortunately, this is happening more frequently today.

There are several ways to lose your license. One of the more common reasons is driving without proper auto insurance coverage. Unfortunately, this is happening more frequently today.

Statista, a Dow Jones partner, displays data on its website of each state’s share of uncovered motorists.

Maine and Massachusetts come in dead last, according to their data. Both of these states have 4.5% of their residents driving without proper auto insurance coverage. Mississippi has the highest number of uninsured motorists.

Almost one-third of Mississippi residents, about 28%, have no coverage.

Lack of car insurance leads to a suspended driver’s license. This could mean that, not only do these drivers have no insurance, but they also have revoked driver’s licenses.

This automatically places you in the high-risk group for two reasons. You place others in danger because if an accident happens, you cannot provide them with monetary compensation. The other, more serious issue is you do not comply with your state laws. You cannot drive legally without a valid driver’s license.

Traffic Violations, Tickets, and Points

Using poor judgment can land you in hot water, not only with the law, but also with the car insurance industry. Many people have received at least one or two points. However, the good news is the points do not remain on your license indefinitely.

Under normal circumstances, any points you acquire start to drop off within a year or two. After three years, you should be in the clear. This, of course, depends on your state.

The point system for Tennessee makes it very easy for you to go from a low-risk driver to a high-risk driver because the state has strict motor vehicle rules.

For example, receiving speeding tickets is the fastest way to add points in this state. Even if you only drive one mile per hour over the posted speed limit, a police officer has the right to stop you. If you receive a ticket for speeding, you also receive one point.

For example, receiving speeding tickets is the fastest way to add points in this state. Even if you only drive one mile per hour over the posted speed limit, a police officer has the right to stop you. If you receive a ticket for speeding, you also receive one point.

If you speed within a construction area, the point value doubles to two points and so on for every other incident. You could go from one point to two or from three points to six. In just a few minutes, you can damage your driving record.

Some auto insurance providers consider just one point on your license as justification for increasing your rates so you need to be extremely careful.

You do not have to have an accident for the auto insurance company to change the way it sees you.

Your Car Makes an Impact

In addition to the major reasons your car insurance provider can put you in the high-risk class, you should remember your car matters, too. Even if you always drive safely and have a decent driving record, the insurance company may still think you drive a high-risk vehicle. It may not seem fair for them to penalize you simply because of your taste in cars. However, many people face this issue.

Start by reviewing consumer guides and comparing company ratings. You can find this information at your state Department of Insurance website. The site provides all residents with tips for buying car insurance, including recommended coverage levels and ways to save money.

Start by reviewing consumer guides and comparing company ratings. You can find this information at your state Department of Insurance website. The site provides all residents with tips for buying car insurance, including recommended coverage levels and ways to save money.

You may find that certain types of sports cars, SUVs, and hybrid models carry negative stigmas that cause you to move from low or medium risk, directly to high-risk.

If you must buy a certain kind of vehicle that your car insurance company thinks has more risk factors than others do, compromise to balance things. For instance, a Ford Mustang has power and strength, which could cause auto insurance companies to increase the speeding risk factor.

Should you opt for a base model, instead of the Boss 302 Coupe, your choice could reflect a more responsible frame of mind. The base model is a 3.7-liter vehicle with a V6 engine, while the Boss 302 has a V8 engine with 5 liters.

Sports cars are not the only kinds of cars that could give you trouble. Luxury cars also carry certain risks because of theft. If you have a luxury vehicle that draws lots of attention, your car insurance company may not write you a policy with low-risk rates, regardless of your driving history.

Make Changes if Possible

Make slight changes, if possible, to keep your rates as low as they can get them, even if you are in a high-risk group. Some shifts are easier than others are, but if saving money is important, you should at least try.

First, speak with your car insurance provider and find out why your rates are so high. They may use unfamiliar terms, but do not let this intimidate you. Always be upfront and ask them to explain everything in detail. Remember that they are the professionals. Therefore, it is up to them to provide you with answers to your questions so you have clarity of the process.

First, speak with your car insurance provider and find out why your rates are so high. They may use unfamiliar terms, but do not let this intimidate you. Always be upfront and ask them to explain everything in detail. Remember that they are the professionals. Therefore, it is up to them to provide you with answers to your questions so you have clarity of the process.

Once you have the specifics, make the easiest and least expensive changes first. Remember, low-cost coverage is not a myth, but it will take a lot of research and price shopping to find affordable coverage that meets your needs. Never attempt to accomplish anything too difficult, as it could discourage you from the onset.

Use your resources, like the Motor Vehicle Commission, for ways to improve your driving history and see if they can give you a few reports for you to study. You may need to see car theft statistics. You may also need to find out how they assess points for every violation.

Visit your local law enforcement officer to see the latest trends in your area. You might even find out where they issue the most citations or where the most crimes occur. This could help you in many ways, especially when it comes to theft and speeding tickets.

Stay Positive

Do not beat yourself up or think you are a failure because of your current status. You can turn things around quickly as long as you recognize your weak areas and make strides toward improvement.

Remember, no one can claim to have perfection in every aspect of his or her driving history. The only differences between you and a medium to low-risk driver are your decisions.

There are many people with slight infractions, who do not believe they are hazards. Unfortunately, the number of very poor drivers tends to cause more problems overall. Do your best to refrain from negative behaviors and begin to exude positive characteristics that car insurance providers look for and you should see favorable results.

In addition, always put thought into your choices when it comes to car purchases. Remember that some vehicles could cost you more, not just on their price sticker, but also with your annual premium. It is essential that you consider these issues prior to making your final purchase.

However, if you do decide to go ahead and buy, just be sure that you have the necessary funds to cover the cost.

You have several ways to receive great car insurance rates by popping your ZIP code into the FREE box!